How the Beef Checkoff supports technology and state-of-the-art research to disseminate meat demand data and grow industry knowledge.

To help drive consumer beef demand, the Beef Checkoff works to understand beef’s place in the protein marketplace. To successfully understand beef demand, the Beef Checkoff must first recognize consumer demand, views and preferences for all proteins, including meat alternatives.

A One-Stop Shop

For Glynn Tonsor, Ph.D., understanding consumer meat and food demand comes naturally. While growing up on a hog farm in Missouri, Dr. Tonsor quickly developed an interest in agricultural markets and pursued that interest, eventually taking on his current position as a professor in the Agricultural Economics department at Kansas State University.

Today, Dr. Tonsor executes and authors the Meat Demand Monitor (MDM) project, funded in part by the Beef Checkoff and Pork Checkoff.

Today, Dr. Tonsor executes and authors the Meat Demand Monitor (MDM) project, funded in part by the Beef Checkoff and Pork Checkoff.

The MDM tracks U.S. consumer preferences, views and demand for meat with separate analysis for retail and foodservice channels. It is a monthly online survey with a sample of more than 2,000 respondents reflecting the national population. A third-party company continuously collects this consumer data every month. Overall, the MDM is a one-stop location for meat demand trends and assessments and is also available for all audiences.

Early on in his career, Dr. Tonsor noticed a knowledge gap on the demand side. According to him, one central theme continued to materialize through his research and discussions – producers don’t understand the importance of meat demand.

“Producers are used to watching the monthly cattle-on-feed report, reading annual cattle inventory reports and a whole wealth of supply-side monitoring, and that’s valuable,” he said. “On the demand front, there’s a lot less parallel information, and what does exist is pretty lax.”

Dr. Tonsor recognized the issue and information gap, talked to industry professionals, started a partnership with the U.S. Cattlemen’s Association (USCA), a contractor to the Beef Checkoff, and received approval and funding for the MDM project. In February of 2020, the MDM was officially up and running to increase knowledge about U.S. meat demand and help producers understand its importance.

Key Trends

Because the MDM was functioning before the coronavirus pandemic, the data gathered has proved valuable, specifically on foodservice versus retail insights.

“The main finding would be that, to date, retail beef demand has increased while foodservice peak demand has decreased,” Dr. Tonsor said. “This finding is important, not necessarily surprising, but we’re able to track it. And maybe at some point, we’ll see that being unwound. Hopefully, as 2021 concludes, we’ll start seeing the foodservice sector recover.”

The MDM has collected additional insights on the coronavirus’ impact on meat demand. These have been summarized in three separate COVID-19 special reports. The November report detailed how, even when consumers get vaccinated, about one-third of the people surveyed say they will not return to in-restaurant dining.

“Asking about a COVID vaccine isn’t in itself a meat demand question, but when you follow it up with a question like ‘How will you alter your dining out, sit-down and restaurant behaviors?,’ we’re able to understand what’s needed to help the recovery of the foodservice segment,” Dr. Tonsor said.

Analyzing these trends is critical for the Beef Checkoff to judiciously invest producers’ dollars in future projects to reach a new era of eating-at-home consumers.

Protein Values

Beef Checkoff marketing decisions take into account consumers’ protein values. These protein values—taste, freshness, safety, price, nutrition, health, appearance, convenience, hormone and antibiotic-free, animal welfare, traceability and environmental impact—are measured monthly and ranked by the respondent’s priority on the MDM.

Nearly all Checkoff-funded efforts and initiatives address at least one of these protein values, and more often than not, more than one. The MDM allows the Checkoff to continue measuring the relative importance of each protein value.

Every month the MDM results are consistent – taste, freshness and safety are a top priority for consumers.

“Every month, across 2,000 people, these protein values show more importance than things like animal welfare and environmental impact,” Dr. Tonsor said. “That doesn’t mean those values don’t matter, but they’re not the core decision driver for meat demand. They matter secondary, but not primary.”

These insights prove the Beef Checkoff should continue to invest in efforts and initiatives that sustain or enhance the taste, freshness and safety of beef.

Supporting Ongoing Information

As an industry, it’s hard to forecast the future. Often, industry stakeholders look back after the fact and wish there would have been more data available to make better decisions.

“I wish I had one or more years of pre-COVID meat demand monitor data. If I had that, I’d have richer insights on the COVID shocks,” Dr. Tonsor said. “I still consider this a success, and I hope others consider this a success, but this shows we need to continue to support projects that give us ongoing data and information.”

The Beef Checkoff is proud to partner with USCA and Kansas State University on this research project to grow knowledge on consumer meat demand.

MDM reports, survey instruments and raw data are available here: https://www.agmanager.info/livestock-meat/meat-demand/monthly-meat-demand-monitor-survey-data

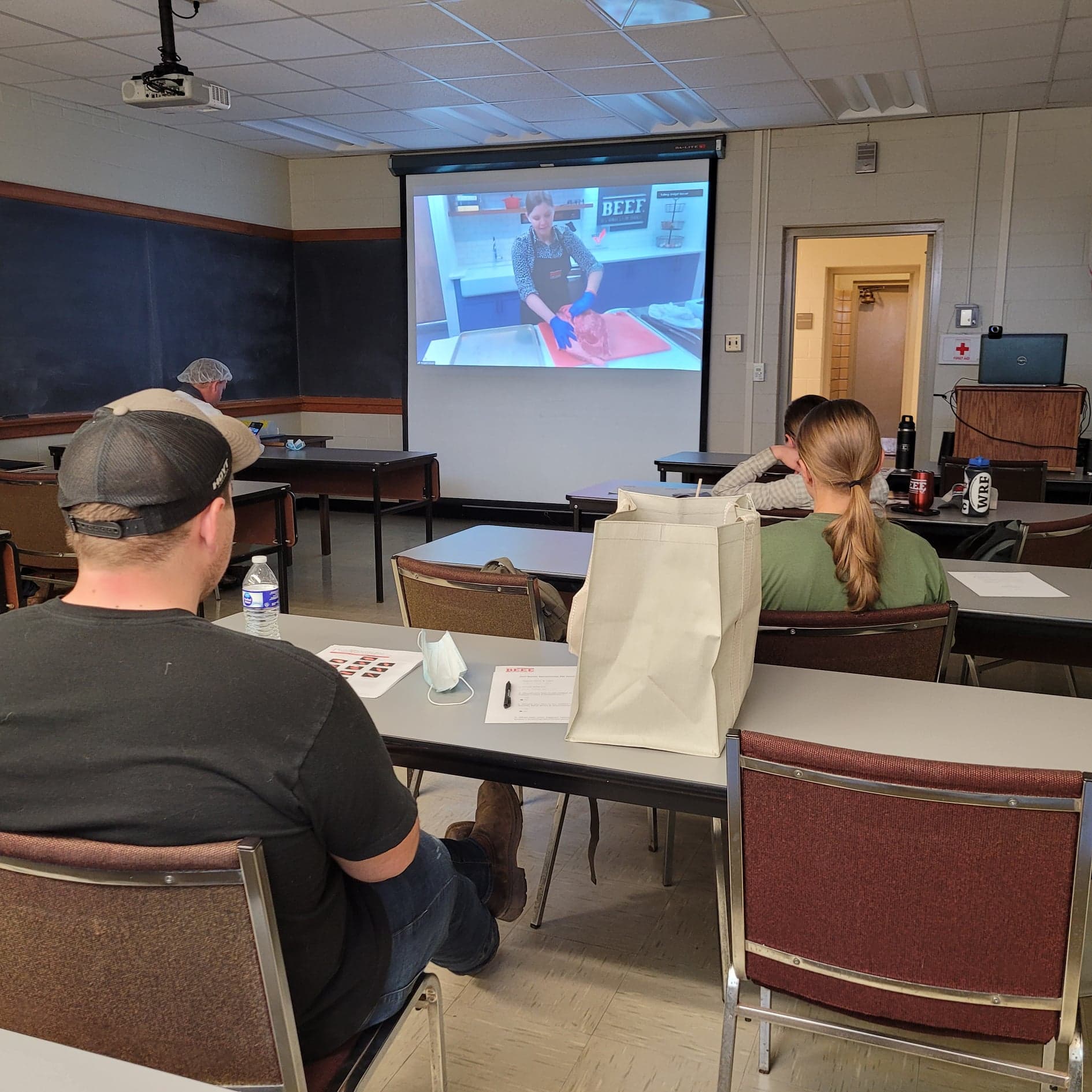

Penn State’s Butcher School students walked through the fabrication and breakdown of two chuck subprimals with Bridget Wasser, senior executive director of product quality and education with the National Cattlemen’s Beef Association (NCBA), a contractor to the Checkoff. NEBPI was present to make the introduction as the local contact for all things beef.

Penn State’s Butcher School students walked through the fabrication and breakdown of two chuck subprimals with Bridget Wasser, senior executive director of product quality and education with the National Cattlemen’s Beef Association (NCBA), a contractor to the Checkoff. NEBPI was present to make the introduction as the local contact for all things beef. Leading up to the official kickstart of summer grilling season, NEBPI will partner with FreshDirect, an East Coast online retailer giant, to speak to beef’s flavor and versatility.

Leading up to the official kickstart of summer grilling season, NEBPI will partner with FreshDirect, an East Coast online retailer giant, to speak to beef’s flavor and versatility. Beef will be featured in June for Nutrition Month at Giant Foods. Giant’s nutrition program gives shoppers access to a team of licensed nutritionists and registered dietitians to help them make the best choices for their families’ health.

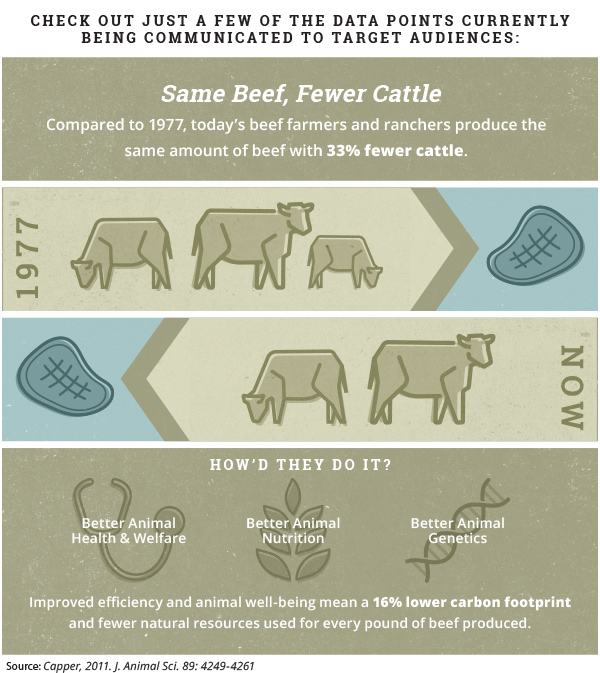

Beef will be featured in June for Nutrition Month at Giant Foods. Giant’s nutrition program gives shoppers access to a team of licensed nutritionists and registered dietitians to help them make the best choices for their families’ health. The Beef Sustainability Research program provides consumers worldwide with proof of beef producers’ commitment to responsibly raised beef. This Checkoff-funded program assesses beef sustainability using an approach that balances environmental responsibility, economic opportunity and social diligence across the beef value chain. This research is conducted to provide science-validated sustainability indicators that serve as industry benchmarks and provide a path forward to continuous improvement. The research encompasses the entirety of the beef industry, from the birth of a calf to beef on the consumer’s plate. This research program is a proactive and innovative scientific approach to creating a sustainable beef product for a growing world population while increasing consumer confidence in beef.

The Beef Sustainability Research program provides consumers worldwide with proof of beef producers’ commitment to responsibly raised beef. This Checkoff-funded program assesses beef sustainability using an approach that balances environmental responsibility, economic opportunity and social diligence across the beef value chain. This research is conducted to provide science-validated sustainability indicators that serve as industry benchmarks and provide a path forward to continuous improvement. The research encompasses the entirety of the beef industry, from the birth of a calf to beef on the consumer’s plate. This research program is a proactive and innovative scientific approach to creating a sustainable beef product for a growing world population while increasing consumer confidence in beef. Today, Dr. Tonsor executes and authors the Meat Demand Monitor (MDM) project, funded in part by the Beef Checkoff and Pork Checkoff.

Today, Dr. Tonsor executes and authors the Meat Demand Monitor (MDM) project, funded in part by the Beef Checkoff and Pork Checkoff. Family Features Campaign Highlights Veal’s Versatility – This social media and digital-focused campaign with Culinary.net uses veal as a popular and trending recipe ingredient for families. One new recipe was a

Family Features Campaign Highlights Veal’s Versatility – This social media and digital-focused campaign with Culinary.net uses veal as a popular and trending recipe ingredient for families. One new recipe was a  Consumers Gather for the ‘Love of Veal’ – Nine consumers joined both in-person and virtually from around the nation to take part in a veal cooking experience with Chef Patrick Rae and a wine tasting with Laurie Forster. The class taught consumers how to make two veal recipes with a romantic theme for Valentine’s Day. There was a 45 percent increase in comfort level among the participants in cooking veal following this class. Overall, participants gave the class 4.5 stars. More consumer cooking classes are planned for the rest of the year.

Consumers Gather for the ‘Love of Veal’ – Nine consumers joined both in-person and virtually from around the nation to take part in a veal cooking experience with Chef Patrick Rae and a wine tasting with Laurie Forster. The class taught consumers how to make two veal recipes with a romantic theme for Valentine’s Day. There was a 45 percent increase in comfort level among the participants in cooking veal following this class. Overall, participants gave the class 4.5 stars. More consumer cooking classes are planned for the rest of the year. To deliver the high-quality protein consumers want, Copeland is working aggressively to expand the number of importers and distributors in the region who purchase U.S. beef. Also, Copeland is executing efforts to introduce beef to the retail and HRI sectors in South Africa. One of these efforts was a brochure outlining the quality attributes of beef liver in the Zulu language, and it was translated into French for use in Morocco. USMEF also plans to print the brochure in the Xhosa language as well.

To deliver the high-quality protein consumers want, Copeland is working aggressively to expand the number of importers and distributors in the region who purchase U.S. beef. Also, Copeland is executing efforts to introduce beef to the retail and HRI sectors in South Africa. One of these efforts was a brochure outlining the quality attributes of beef liver in the Zulu language, and it was translated into French for use in Morocco. USMEF also plans to print the brochure in the Xhosa language as well.